What is Customer Lifetime Value?

- larry cohen

- May 30, 2022

- 13 min read

Updated: 3 days ago

In the most basic terms, customer lifetime value measures how much a customer will spend over their entire “lifetime” with your company.

Customer lifetime value goes beyond traditional marketing practices by providing insight into a customer’s long-term value to your business. That means digging deeper into the data around:

customer behavior

purchase history

brand interactions

This allows you to:

better understand your target market

develop strategies for acquiring new customers

identify opportunities for upselling or cross-selling products

maximize profits from existing customers

Now you know what it is, let’s discuss why it matters.

Why Customer Lifetime Value (CLV) Matters

Understanding how to measure customer loyalty is increasingly important in today’s competitive market. However, what’s the best way to monitor it? A key metric you’ll want to keep track of is the customer lifetime value (CLV).

Let’s delve deeper and explain why customer lifetime value is so important.

Customer Lifetime Value is the Best Analytics Metric

CLV sweeps away all other metrics because it focuses on long-term value, not the flash-in-the-pan appeal of visitor spikes and seasonal fluctuation. Customer lifetime value balances the profits in the e-commerce universe by flattening the peaks and troughs into a straight line of either success or failure.

Customer Lifetime Value Affects Every Area of Business

CLV matters because it affects every area of your business. Take a look at how the customer’s lifecycle (lifetime value or LTV) impacts virtually every sector of an e-commerce business.

What do you see beyond the labels in the diagram above? I see marketing, strategy, outreach, UX, development, product, customer service, management decision-making, sales, PPCs — basically everything that makes an e-commerce business viable. LTV is part and parcel of it all.

Increasing LTV means higher profits.

LTV is also important because it shows you the path to higher profits. If you increase LTV, then you increase profits, plain and simple.

According to Marketing Metrics, the possibility of selling to a new prospect is 5-20%, but the probability of selling to an existing customer is 60-70%. By focusing on returning customers — their lifetime value — you are focusing on a strategy that gives your business higher profit margins.

BigCommerce, an e-commerce store provider, writes,

To ensure a high profit, it’s important to influence your customers to keep coming back to purchase. That means you want your churn to be low so that once you acquire a customer, they continue to come back and purchase again and again. Lower churn means higher LTV and a healthier business overall.

It isn’t enough just to know how much you spend to acquire a buyer.

You also need to know how much each customer is worth to your business.

Why? Because it gives you tremendous power.

Back in 2012, Amazon founder Jeff Bezos shocked the tech world by admitting that Amazon doesn’t make a profit on Kindles. Fast forward to 2022, and that’s still the case.

Why would the company spend millions developing a product that doesn’t make them money?

Because Amazon knows the total value of each customer and is willing to invest in products to increase that lifespan. In the case of the Kindle, the bet paid off.

According to Bezos, people who buy Kindles read four times more books than they did before investing in Kindles.

Additionally, they don’t stop buying paper books. Kindle owners buy hardbacks, paperbacks, and audiobooks, too.

The Kindle is, at its heart, a marketing strategy — a strategy that Amazon could only deploy with a solid understanding of a customer’s lifetime value, or LTV.

But shockingly, LTV is out of the reach of most businesses, according to Invesp.

Few understand this number. Let’s change that.

How To Calculate Lifetime Value: The Infographic

You already know about customer lifetime value, but hold up! How do you calculate it? In this graphic we’ll briefly cover how to calculate LTV and how to use LTV to help solidify your marketing budget. Special thanks to @avinash.

Click on the image below to view an enlarged version of this infographic.

If you sell a subscription product or software-as-a-service, it’s easy to calculate the average value of a customer.

Just take each billing cycle — one month, let’s say—and figure out how much the average customer spends.

If you don’t bill for a product on a regular basis, the math gets a little trickier. You’ll need to figure out two metrics: the frequency of the purchase cycle and the value of each purchase.

For example, an e-commerce site would calculate the size of each cart and how often customers order.

A company like Starbucks, with multiple purchases per week, calculates it like this, according to an analysis by Kissmetrics.

But there may be other factors at play. Double-check these before making your number final.

Second, account for pricing variables.

Not all customers pay full price.

In fact, some industries make full price such a rarity that it’s an almost meaningless number.

J.C. Penney, for example, makes 99% of its revenue from items sold on sale, and three-fourths of this is marked down 50% or more.

Counting the LTV of a customer based on the ticket price is foolhardy if most purchases are discounted.

Instead, find the real price the customer pays. Exclude discounts, commissions, and processing fees (the percentage points that go to Stripe or Square or PayPal aren’t yours, so don’t count them).

Now that you know the actual value of one purchase cycle, let’s extrapolate that out to the customer’s lifetime.

Third, establish the lifetime of the customer. This isn’t literally how long your customer lives.

Instead, it’s the length of time a customer remains loyal to you. This number can be huge — the average customer lifespan of Starbucks is 20 years.

Of course, you won’t find a range like this if you’re just starting out (Starbucks couldn’t have known this ten years after opening its doors).

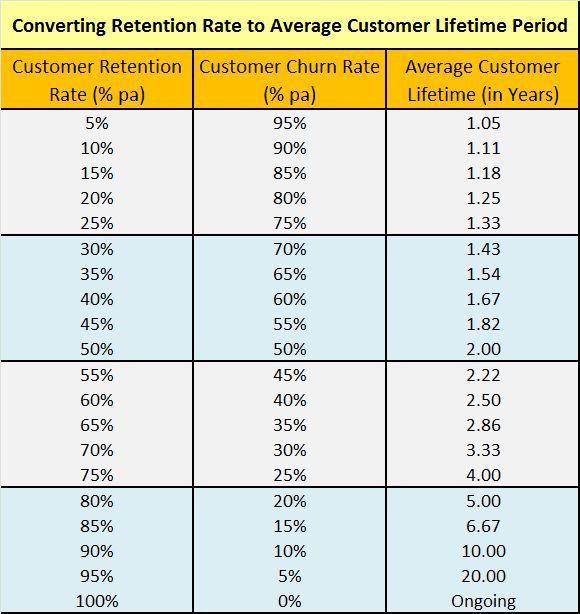

Instead, you can find the annual churn rate — or percentage of lost customers — each year.

Divide 100% by this churn rate. It’s a relatively simple calculation, but this reference chart can make it easier.

As you’ll notice, improvements have a greater effect on lower churn rates.

While cutting churn rate in half from 90% to 45% only brings up customer lifespan by one year, reducing churn from 10% to 5% adds a full decade to the lifespan.

The lesson to be learned is not to be complacent once you have a low churn rate. That’s where you’ll find the biggest rewards.

Once you know the value and frequency of each buying cycle, just multiply it by the customer lifespan.

If your customer spends $20 per month and stays with your company for 2.5 years, he or she has a lifetime value of $600.

Using LTV and Customer Acquisition Cost (CAC)

Let’s talk about LTV and customer acquisition cost, but first, time for a quick definition. CAC measures the amount it costs to acquire a customer. That means everything you spend on marketing, sales, and the usual costs of running a business (equipment and premises).

If you spend less to acquire a customer than that customer is worth, all is well! If you can get a new customer for $100, and she spends $150 with you, keep at it.

Of course, the opposite is true. Remember, no matter how small the difference, a lower CAC than the LTV is always problematic.

Spending $100 on a customer who spends $99 over his or her lifetime may seem worthwhile — maybe you can get the customer to spend more? — but it’s rarely a smart move.

If that’s the case with you, the first thing you need to do is to spend less money to acquire each customer.

How To Grow CLV

Customer lifetime value is more than a number.

It shows how well your company knows its customers and how successfully you create long-term relationships with them. There are two main approaches to increasing customer lifetime values, which means getting your customers to buy more and boosting their order values.

Here are some tips on how to maximize this important metric.

1. Publish An Engaging and Informative E-blast or Newsletter

There are few things as tried and tested as the newsletter, and it’s a great method of improving LTV. Why?

Well, a newsletter engages your audience and keeps them interested. I mean, how can they forget about you if you send them regular emails?

However, before you start sending newsletters, segment your customers. A targeted email to customer segments is far better than a generic email sent to a huge mailing list.

Below are other ways you can make your emails more helpful, and potentially increase your customer lifetime value simultaneously.

Make Your Emails Worth Reading

Want your customers to keep reading your newsletter? If you’re using newsletters to increase your customer lifetime value, then you’ve got to make them worth reading. For instance, if you’re selling products or services, send tutorials and tips so buyers can get the most out of your products. Here are some other insights to create readworthy emails:

Include user-generated content to show how others are using your product.

Give buyers sneak peeks of new products

Host contests and give small rewards like vouchers, or a small discount for entrants

Finally, ask your subscribers what they want to see more or less of.

Test Your Subject Lines

There’s no getting away from the importance of your subject lines. A/B test them, optimize your subject lines, and keep testing and improving.

Send your emails on a regular basis

How many emails should you send each month? According to Omnisend data, 10-19 emails a month should be your aim. However, that’s not written in stone.

The bottom line is that you need to find a frequency that’s right for your customers and your business. You can test your email open rates, CTRs, etc.

You can also give your customers the choice (for example, weekend newsletters only).

2. Create As Many Engagement Points As Possible

How would you like to create an environment where your customer is constantly exposed to your message? You’re a perpetual presence. Whether browsing Facebook, sending a Tweet, or even posting to Instagram, your brand and messages are there.

By engaging with your customers in many different places and methods, you increase that customer’s lifetime value. You become embedded in the customers’ minds, influencing their buying, affecting their browsing, and subtly moving the needle on their customer lifetime value.

Here’s a straightforward way to improve customer lifetime value by creating multiple engagement points.

Make a list of the places where your customers spend time, both online and offline.

Develop an advertising or content marketing presence in those places.

Encourage your customers to engage with your brand on those platforms.

One of the most basic methods of applying this is using social connection points on your website. Like so:

Here’s how Hubspot uses it:

Make a presence. Make it big. And encourage people to be a part. Have a presence across multiple channels, and you’ll start to improve your customer lifetime value.

3. Develop A Recurring Payment (Subscription) Model

One of the most powerful ways to improve customer lifetime value is by introducing a subscription model. This option gives you a recurring revenue stream. Customers pay more, last longer, and become highly valuable.

Consider a standard e-commerce LTV calculation. In this best-case scenario example, a customer makes four purchases a year. Total revenue: $280.

Now, what about a subscription model? Let’s take one popular subscription service as an example:

With the annual cost starting at $130, Birchbox gains a customer who sticks with it, vastly improving customers’ lifetime value.

Whereas the traditional model of e-commerce has an unpredictable customer lifetime value, the recurring subscription model produces a steady stream of income that lasts longer and creates more value and profit long-term.

4. Upsell and Cross-sell

It’s easier to sell to your existing customer than to try and get a new customer on board. When you do so, you improve the lifetime value of that customer exponentially.

Upselling is the e-commerce equivalent of stepping on the gas. Sure, you’ll get where you’re going if you don’t upsell, but you will get there a lot faster by upselling.

The example below graphs how upsells improve SaaS profitability, but the principle holds true in any e-commerce venue or niche. Upselling provides more profitability, more growth, and faster time to profit.

Upselling and cross-selling produce far more profit than you’d ever get from average customers. That said, upselling isn’t something that you leave to chance. You have to put some thought into the process, offer additional packages that offer value for your customers, and improve the customer experience.

5. Improve Customer Service

One simple way to improve customer lifetime value is improving the quality of your customer service.

The happier your customers are, the more likely you are to retain them, and customer retention is essential to your:

Customer loyalty

Return on investment

Business growth

In addition, keeping your buyers long-term is another way to increase your customer lifetime value.

Here’s an example. If I asked you to name one of the most popular e-commerce sites, you’d likely say Amazon. Coincidentally, Amazon is among the best at keeping its customers, by:

Providing a stellar customer experience

Using personalization (for instance, offers tailored to the customer’s interests and addressing them by name).

Being quick to respond to queries and offer solutions

OK. You might not have Amazon’s resources. However, there’s plenty you can do to enhance your customer service along with your customer lifetime value. Just follow these tips below:

Emphasize quality over quantity.

Be responsive. Ensure phone calls and emails get answered.

Publish authoritative content.

Overdeliver when things go wrong, like offering a full refund or a discount.

Acknowledge the customer’s concern.

Smile. Smile on the phone. Smile in your emails. Just smile.

Provide discounts for loyalty.

Be patient with angry customers.

Combine your knowledge of the product with your knowledge of individual customers.

Use positive language as often as possible.

Never give up on an exasperating customer.

Use customer interactions as a learning experience

Finally, remember to always put your buyers at the heart of your business and build relationships; you’ll be well on your way to improving customer lifetime value.

6. Offer A Referral Program

Why offer a referral program? Because research shows they can improve customer satisfaction. These types of programs reward both existing and new customers for recommending you to their friends, family, or colleagues. Not only does it make your customers feel valued, but when done correctly, it can significantly increase customer lifetime value. By offering financial incentives in the form of discounts or free products and services when they refer someone who makes a purchase, customers are more likely to recommend you. Additionally, existing customers will be encouraged to stay with you as they receive ongoing rewards for each successful referral. Furthermore, these types of programs can help spread word-of-mouth marketing quickly while also increasing your visibility on social media platforms such as Facebook and Instagram. Here’s an example. Chase offers a $50 reward for introducing a friend. Existing customers can refer up to 10 friends a year for an extra $500.

If you’re already a Chase customer, an extra $500 a year just for recommending the brand is pretty irresistible, right?

That’s all you’ve got to do.

Create an offer your customers can’t resist, and watch as they (hopefully) refer buyers your way.

7. Implement Personalization In Your Marketing

It’s indisputable. Personalization builds customer relationships, and it can yield big rewards. With the right strategies, you can increase customer lifetime value and continue to grow your business.

Indeed, research shows that seventy-one percent of customers want brands to offer a personalized service. According to McKinsey:

personalization boosts performance and improves customer outcomes

companies that grow faster drive 40 percent more of their revenue from personalization

There’s a simple reason why.

A personalized experience allows you to cater to the needs of each customer, making them feel more connected to your brand.

When customers feel valued and appreciated, they are more likely to become loyal patrons who remain engaged (customer retention), thus increasing customer lifetime value over time.

Creating an effective personalization strategy requires understanding who your customers are and how they interact with your brand. To do this, you need to gather data about their:

demographics

preferences

buying habits

You can then segment your customers and create personalized content/offers.

8. Make Sure Your Content Keeps People Engaged

How do you keep people coming back for more? With engaging content that keeps them switched on. Ultimately, creating expert, engaging content establishes trust with potential customers while keeping current ones around longer.

The result? Higher customer lifetime value.

That means creating easy-to-absorb content that’s informative and actionable; it also means ensuring your content is visually engaging.

You can do that by adding visuals like images and infographics. Don’t overlook video content, either, as research shows it improves customer retention.

However, whichever type of visuals you go for, make sure that it reflects your business values, educates leads, and speaks to the consumer’s needs.

You could also try:

User-generated content

Launch contests

Behind-the-scenes features

Online chat options

You’ve got your customers engaged, now let’s move on to feedback.

9. Collect And Act On Feedback

Want a ridiculously easy way to encourage customer lifetime value? Then collect and act on feedback.

By collecting customer feedback, you can get valuable insights into what your customers like, what they don’t like, and how they view your products or services. Use the information customers give you to hone in on areas of improvement and improve sales strategies.

If enough customers are saying the same thing, that’s a sure sign you’re getting something wrong.

For instance, perhaps customers think that your shipping costs are too expensive. Maybe you could combine shipping or look at alternative mailing services. Alternatively, you could offer free shipping for higher order values, if that makes financial sense.

As a business, your reward is the potential for increased customer lifetime value, and that’s awesome news for any company.

That’s not the only benefit, though. When you offer a superior customer experience, 43 percent of buyers are happy to pay more.

FAQs

How often should I calculate the lifetime value of a customer?Determining the optimal frequency for calculating lifetime value is not always easy. It may help to calculate lifetime value whenever there are changes to pricing plans, discounts, or other influencing factors. That way, you’ll have an accurate picture of how these changes are impacting your bottom line. What is the difference between LTV and CLV?Lifetime Value (LTV) shows the amount that customers will bring over the total time they interact with your company. Customer lifetime value (CLV) shows how much an individual customer will bring over the total time they interact with your company. How can I increase the lifetime value of a customer?Finding out what drives customers makes it easier for a business to tailor its products or services to meet those needs. Additionally, forming relationships with customers helps build longer-term loyalty and trust. Providing rewards such as discounts or exclusive offers can also help encourage repeat purchases from existing customers and even attract new ones along the way. Finally, creating a positive customer service experience can be integral in turning customers into lifelong supporters, increasing the customer lifetime value.

Conclusion

Customer lifetime value is an important metric to consider when assessing the success of your business. It helps you to identify which customers are most valuable and target them with strategies that encourage them to maintain a long-term relationship with your company.

Fortunately, there are plenty of simple steps you can introduce to increase customer lifetime value, like using personalization, responding to and acting on feedback, and creating engaging content.

In the end, the lifetime value of a customer comes down to keeping your customer coming back for more.

Earn their trust, gain their loyalty, and create referral systems they can’t resist, and you are well on your way to boosting your customer lifetime value.

How do you increase customer lifetime value? Share your tips below.

コメント